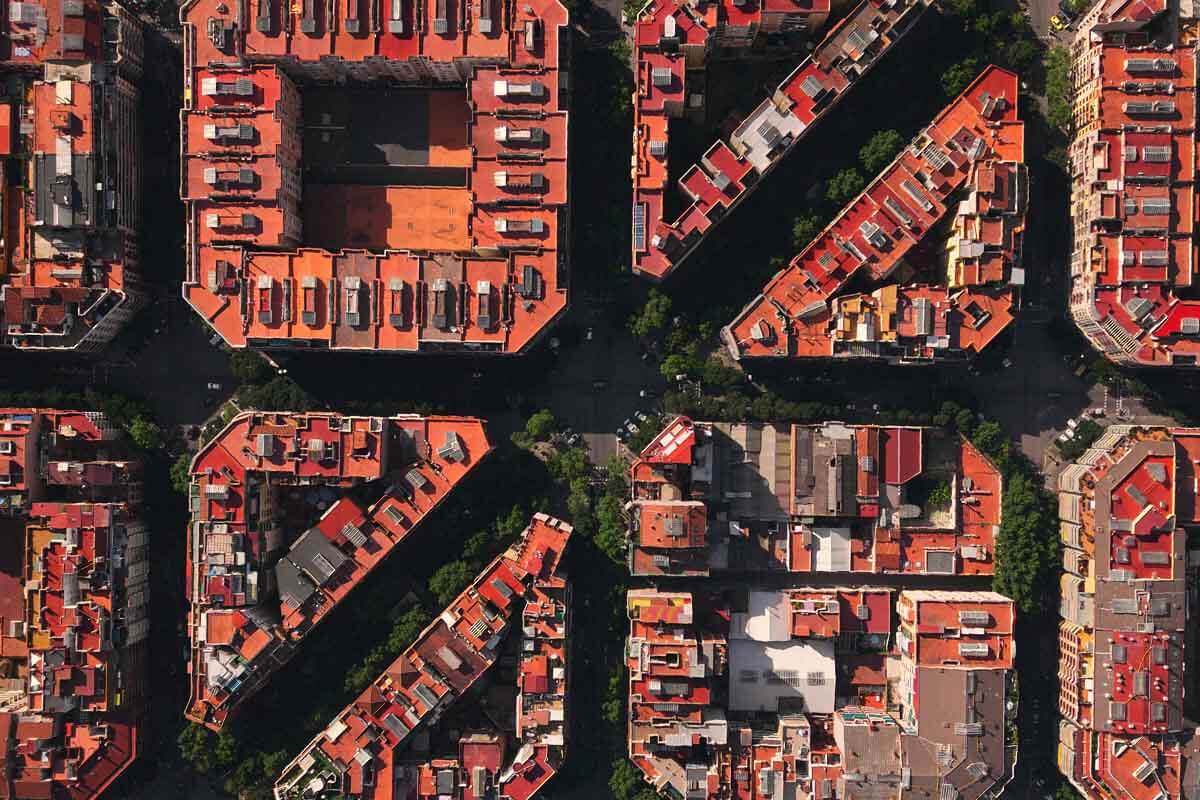

For 10 years, the Spanish economy has relied on the real estate sector. This led to a revaluation of assets and increased apartment prices by 177% since 1995. «Brick fever» has become a key thing that affects national growth.

Much of the recent recovery in the Spanish economy is because of the boom in construction. It’s a low-productivity sector that doesn’t fit into the model of technology, innovation and competitiveness set by European Union (EU) governments in the Lisbon Agenda.

Content:

- What events affected the Spanish real estate market?

- What events are expected in 2022 and how can they affect the Spanish real estate market?

If we look at the history of this process, we should go back to 1992 when the real estate bubble burst and inflated in the second half of the 1980s. In the 3 years after that, real estate prices fell by 15%.

The productivity of the Spanish economy since growing less than the European average goes hand in hand with high construction growth rates. These changes aren’t seen in most neighboring countries.

Because of market instability, savings in this sector were at the expense of other investments.

Prices began to rise in 1996 mainly because of pressure from property buyers and low returns on stock markets. And this has been going on for 10 years.

This happened even though at the end of 2005, as the Ministry of Real Estate Construction confirmed, this increase slowed down. The yearly increase in the average price of new real estate is higher than this figure in many Spanish areas.

What events affected the Spanish real estate market?

7 times more than the average salary

The total increase in house prices in Spain from 1997 to 2005 was an impressive 177% - 7 times higher than wage growth.

The causes of this demand-side real estate inflation are well known: consistent low-interest rates, long mortgage terms, intensive participation of credit institutions, changes in households (because of immigration and smaller family units), foreign buyers and pressure on the market from investors.

Without other, more profitable alternatives, much of people’s savings were for buying real estate as part of speculative behavior is encouraged. The change of the «brick» into a preferred investment product means that decisions based just on making money from an asset are what determined how the market grew.

As for supply, over the past 5 years, the number of homes under construction has been more than 700,000 per year. Construction has changed large cities and caused incredible growth.

So, the new supply is much more than the demand for primary housing. Although new types of households and labor mobility explain this trend, it’s estimated that half of the total real estate is for second homes and investments. Much of society faces difficulty getting housing and many others get into huge debt buying homes.

Don’t forget about another factor - the cost of land is 24% of the final value of real estate. Increasing land prices is directly linked to money going to local treasuries as councils use this public asset to get cash. This puts even more pressure on the overheated Spanish real estate market.

Young people were forced out of the real estate market

When looking at the real estate markets of many countries over the past decade, evidence shows that buying housing for investment has is something that directly affects price growth.

So, if according to the 2001 census, 32% of the real estate stock was intended for second housing (occupied or empty), then according to the Ministry of Real Estate, now, this figure is about 35%. This investment goal meant that young people were pushed out of the real estate market because of high prices. This has also happened in countries like France, the United Kingdom and the United States.

The explanation is simple. If buyers are mainly investors, then prices are at too high a level for those under 35. The problem is made worse by high levels of temporary employment which usually means low wages and job instability. Financial institutions decided to extend mortgage lending terms which further increased prices because of decreases in the income needed to buy an apartment. So far, this trick is working but experts fear that rising unemployment could lead to a surge in mortgage debt.

To avoid problems, banks diversify their business. But savings financial institutions will have more problems as it starts an aggressive policy in the sector when it starts to show signs of mild exhaustion. The mortgage burden on households is twice as high as in 2001 and the Bank of Spain warns of high household debt.

The Bursting Bubble and Economic Growth

The bubble in the real estate market began to show through the high growth in real estate prices that significantly went past the CPI (consumer price index) and wage growth. Why? Because of the lack of good land for construction at a good price, tax benefits are given when buying a house, an increase in the population because of immigration, too many loans and land retraining. There’s a lot that goes hand in hand with pure and simple speculation.

For instance, real estate prices in Madrid increased by 176% between 1996 and 2003 as reported by several newspapers. In October of the same year, the European Commission confirmed this situation, warning that the nominal price had doubled in just 1 year. In November, the European Central Bank warned of a downward correction in prices and economic consequences. In June 2004, the Bank of Spain warned of an overestimation of real estate prices by 24-35%.

Between 2005 and 2007, Euribor, the benchmark index for determining the price of variable mortgages, began to grow until it reached 4% in the summer of 2007. Since then, the Spanish government, media and society have been preparing for a looming crisis, both because of the internal situation and because of the consequences of the mortgage crisis in the United States. The «real estate bubble» is a common phenomenon.

During 2008 and 2009, both housing prices and the number of purchases and sales fell sharply. So, both developers and construction companies faced problems related to cash flow and profitability and resorted to liquidation and layoffs. This worsened the country’s economic situation. This persisted until 2015 when signs of improvement began showing up again.

The main consequences of the situation in 2008 were that the real estate market was unstable because of low demand, a sharp drop in prices, the bankruptcy of some banks and savings banks, a large amount of state aid to save them and new legal frameworks.

Regulatory authorities developed many regulations to avoid, if possible, a repeat of the «bubble» in real estate market, which eventually resulted in the well-known makeover of the Mortgage Law. The key to avoiding a new explosion is more transparency, more information for consumers, independent assessments, and a change in mentality that favors buying properties when families can actually afford them.

Impact of COVID-19 on commercial property investment in Spain

The pandemic changed the investment landscape of commercial real estate and divided different types of assets by how much they were impacted by the pandemic’s travel bans. Preferred assets are residential properties, logistics and data centers, as well as most of the retail sector. Among the most affected are office and hotel assets – this has only worsened because of remote working and drops in international tourism.

Before the pandemic, investments in offices and hotel assets were by far the most important in the commercial real estate sector in Spain. It was almost 50% of the total. The segment of commercial real estate (or multi-apartment housing, which includes rental housing as well as dormitories for students and the elderly), retail and logistics were in the background.

The COVID-19 offensive turned real estate investments upside down and led to their fall by 24% to about EUR 9,500,000. Overall, some retail assets, the logistics sector and real estate suffered less or even benefited. The role of supermarkets as suppliers of basic goods for the population helped first, the boom of online commerce helped second, and a combination of these helped the third. Interest in student dormitories has dropped because more online classes and nursing homes have been directly affected by the consequences of the health crisis. Rental housing has gotten new growth because of «build for rent» initiatives and it’s obvious that the trend towards the growth of homes for the elderly will continue, given the country’s population.

At the other end of the spectrum are facilities that until now were the «stars» of the Spanish market: the attractiveness of offices has fallen sharply because of remote work; commercial premises (usually one of the most important parts in the retail sector) have been seriously affected by restrictions on opening hours, capacity, etc. Hotels and inns have suffered from the effects of falling demand.

So, residential properties (28% of the total investment in real estate) became the main investment asset in 2020, followed by retail trade (about 25% of the total) and logistics (almost 15%). In contrast, investments in offices and hotels stayed below 20% of the total.

What events are expected in 2022 and how can they affect the Spanish real estate market?

Many real estate market experts note that housing prices are almost not falling this year. So, adjustments will be postponed until next year. This showed that the stability of the housing market far exceeded expectations.

Forecasts at the beginning of the pandemic were very disappointing and negative numbers reached double digits. But, after looking at the dynamics of the last few months, we can guess that housing prices are stabilizing, which is very encouraging. This will keep the income of some households stable for most of the year. Don’t forget that financing costs have stayed at a low level compared to other years.

Stable real estate prices in 2021

Real estate prices in 2021 will stay stable, falling by only 1% until the end of the year. This will also delay its fall until 2022 when a drop of up to 5% is expected.

The drop in 2021 was recorded mainly in luxury areas of large cities where the revaluation is more than 10%. Rent in the first quarter of 2021 sharply decreased by 10% - 15%. Finally, land prices should begin to stabilize after falling by 10% in 2020.

As experts expected, the decline in housing prices has been postponed and to a lesser extent, it will happen in 2021. All this will lead us to 2022 with a devaluation from 5% to 7%. This situation will not have a significant impact on new construction and secondary housing with a better location – it’ll be more stable.

In 2021, activity in the real estate sector recovered, reaching an increase of 10%, largely due to the return of foreigners. also, by the end of the year, it is expected to close with a 10% increase in real estate activity. But, we’ll have to be patient and wait until 2022 until the number of transactions returns to how it was before the pandemic.

2022 and decline in real estate prices

It’s estimated that housing is overvalued by 6% and the cost adjustment will happen in 2022.

The National Institute of Statistics says that prices have mostly withstood the difficulties they experienced in 2020, with an increase of 1.5%. Even more surprising is that even though there was a sharp decline in GDP (-10.8% in 2020), it stayed high.

Also, housing prices are supported by lower financing costs. Another important factor is ERTEs, which have lessened the impact of the pandemic on workers. Because of this, the gap between housing prices and Spanish household incomes has widened.

The extension of ERTEs allowed the collapse of real estate prices to be postponed until 2022, leaving a small adjustment of about 1% in 2021, which is much lower than was thought at the beginning of the pandemic.

If you’re looking for a real estate agency in Spain that could professionally advise you on the market and forecasts for the future, don’t hesitate to contact us.