Spain traditionally attracts foreign investors and its real estate is popular and in demand among citizens of Great Britain and Spain. These countries are the leaders in the number of transactions among foreigners. According to the Spanish real estate registry, by the fourth quarter of 2021, the number of transactions by foreigners achieved the level reached before the pandemic. In Spain, there is a wide selection of real estate for different budgets. Let's consider the amount you need to invest in the country's housing stock, and in which region of the kingdom property is most profitable.

Content:

- The state of the Spanish real estate market

- Why it is worth investing in real estate in Spain?

- Minimum income for buying real estate in different parts of the country

- Which area has the most active real estate acquisition?

- Additional expenses when buying a property in Spain

- Minimum income for the purchase of real estate with a mortgage

The state of the Spanish real estate market

The pandemic had a direct impact on the state of the market, causing the following main trends:

- A shortage of new buildings caused by increased security measures due to the epidemic. This increased construction costs and reduced the speed of construction.

- Changing priorities. Lockdown has highlighted the importance of additional free space, and buyers have become more interested in spacious facilities. Many preferred not to opt for standard apartments in Spain, but rather detached houses in suburban areas. Since the beginning of the pandemic, the demand for villas has increased by 36%.

However, even with such drastic changes in customers’ needs, 20% more deals were concluded in 2020 compared to 2019. In 2021, the annual sales growth rate was 38%.

Why it is worth investing in real estate in Spain?

Among the basic factors of the attractiveness of Spanish housing, the following can be identified:

- Good geographical location and climatic conditions. A country with access to the coast is attractive both for permanent residence and for seasonal recreation.

- Developed infrastructure. Spain has a stable economy and a high quality of life. No wonder the locals have a high life expectancy.

- Development of immigration programs and an increase in the flow of tourists. The demand for real estate for rent is consistently high.

- Profitability. The demand for housing makes it possible for property owners to receive passive income.

The capitalization of the value allows us to consider investments in Spain’s housing stock in the long term. An apartment or house can always be resold at a higher price compared to the purchase price.

Minimum income for buying real estate in different parts of the country

The area of the country is more than 500 km2. This leads to a fairly wide selection of real estate and a noticeable difference in prices. Apartments in large resort regions are more expensive than in a quiet suburb. In general, the cost of housing depends on the year of its construction, the area, and the prestige of the location. New buildings under construction in Spain can be cheaper than residential complexes that have already been commissioned, especially at the initial stage of sales. However, ready-made secondary housing, built in the last century, may, on the contrary, be cheaper due to non-compliance with modern comfort requirements. Each property is individual, but the average prices per square meter in different areas can still be determined. At the beginning of 2022, they look like this:

- Andalusia – 1824€;

- Aragon – 1329€;

- Asturias – 1348€;

- Balearic Islands – 3353€;

- Valencia – 1485€;

- Canary Islands – 1960€;

- Catalonia – 2317€;

- Madrid – 2967€.

The data is given for several provinces of the kingdom. Housing in the Balearic Islands and Madrid remains the most expensive. You can buy real estate in Extremadura for the cheapest prices. Here, the average cost per square meter is 940€. In small towns, prices can be even lower.

Which area has the most active real estate acquisition?

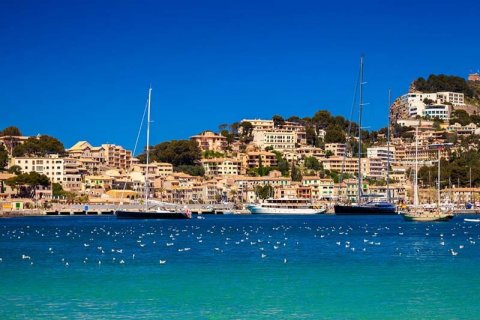

One of the most popular locations in the country remains the Costa del Sol. This is a resort area with upmarket luxury real estate. Malaga is the leader, a city where properties worth over 1 million euros are concentrated. These are more than 23% of the total number of such facilities throughout the country. Even Madrid’s luxury real estate is only 15%. Foreigners also choose housing stock in Costa Blanca, the Balearic Islands, and Tenerife. If the budget is not limited, you can buy a villa in Spain in one of these resort areas and need not doubt the profitability of your investments.

Additional expenses when buying a property in Spain

The main expenses fall on the payment of the cost of the selected housing, however, it is impossible to do without additional costs associated with the execution of the transaction. On average, the list of related expenses is as follows:

- Payment for the services of a lawyer who checks the authenticity of the transaction and the correct procedure for filling out the necessary package of documents. The fee is about 1 thousand €.

- Payment for translation services. If you are cooperating with a Russian-speaking real estate agency, then you can save money on this item.

- Fee for the notarization of documents. This is still about 1 thousand €. An interpreter is also needed at a notary. Usually, payment is taken on a per-hour basis.

- Tax on the purchase of the real estate is calculated from the total cost. The interest rate varies in different provinces and can reach 10%.

- Stamp duty when buying housing in new buildings. Its value ranges from 0.5 to 1.5%.

- Registration fee at the conclusion of the transaction.

- Connection of communications. This includes opening a personal account and installing meters in a new building, which is carried out at the expense of the buyer.

Traditionally, the realtor's services are paid by the seller, unless the contract provides for other conditions.

.jpg)

Minimum income for the purchase of real estate with a mortgage

Mortgage lending to foreigners is not often welcome in many countries. This is due to increased risks, since it may be difficult to collect a debt from a non-resident. An important indicator for obtaining a bank loan remains the solvency indicator, which must be documented. Foreigners can count on a loan of up to 60% of the real estate value. In exceptional cases, it can reach 80%, but individual conditions are set by a particular bank and directly depend on the identity of the borrower, as well as on the purchase price. Thus, you can get a mortgage with an average of 40% of the funds necessary to purchase a property. But even in this case, you can’t do without additional costs. To obtain a mortgage, it is necessary to assess the value of the real estate and the mandatory life insurance of the borrower. The interest rate according to the assessment is from 3 to 6% of the value of the property.